4 Seemingly-Innocent Merchant Errors That Can Cause Chargebacks

Merchants who are interested in establishing sustainable chargeback prevention strategies that yield long-term results are anxious to understand exactly what is causing transaction disputes. Unfortunately, merchant errors are the most overlooked source of chargebacks—triggers that can cause a great deal of damage before they are detected.

Merchant Error: One of Three Chargeback Sources

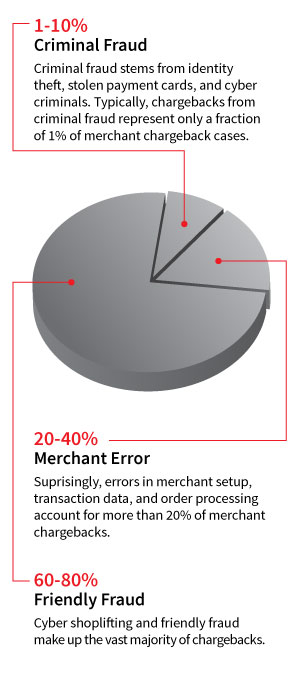

At Strong Call United™, we’ve made a revolutionary discovery. All chargebacks can be traced back to just three sources:

- Criminal Fraud

- Friendly Fraud

- Merchant Error

When managing chargebacks by their source, a couple of things become abundantly clear.

Criminal Fraud is Not the Greatest Threat

Criminal activity is increasing at an exponential rate every year. Studies have found fraud losses totaled $100 billion annually, while global fraud attempts have increased by as much as 215% YoY.

Because the threat is so prevalent, merchants incorrectly assume criminal fraud is the greatest risk they’ll encounter. This is evident by the overly-stringent fraud filter rules that caused the value of false positives to be twice as great as the value of actual criminal fraud.

However, the reality is that modern fraud detection technology is quite advanced. When used in conjunction with manual reviews, data analysis, and customized rules, fraud filters can keep criminal activity—and the resulting chargebacks—to a minimum.

The biggest source of preventable chargebacks is merchant error—which can account for as much as 40% of all chargebacks.

Once merchants recognize the actual source of their chargebacks, they can begin creating effective prevention strategies. But, if merchant errors remain unidentified, needless revenue loss will continue.

Improving Customer Service Helps—But the Impact is Minimal

When our representatives ask merchants, “What is your number one issue that needs to be resolved?”, the most common response is: “We need to improve our customer service.”

When our representatives ask merchants, “What is your number one issue that needs to be resolved?”, the most common response is: “We need to improve our customer service.”

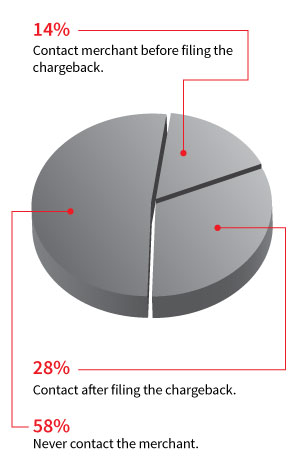

In all probability, most merchants would benefit from an improved customer experience. However, propriety Strong Call Unired research has found just 14% of cardholders who initiate a chargeback contact the merchant before taking action with the bank.

Therefore, focusing energies on improving customer service often has a minimal impact on chargeback prevention.

Rather, merchant’s efforts and resources would be better spent identifying the shortcomings and oversights that are impacting the other 86% of chargebacks.

So, what are the merchant errors that are causing chargebacks?

4 Seemingly-Innocent Mistakes That are Virtually Guaranteed to Result in Chargebacks

For the first-time ever, SCU is giving away proprietary chargeback prevention information—some the “secret sauce” that makes us so successful.

The following are four merchant errors we correct for nearly all of our clients—ones that are basically guaranteed to cause chargebacks.

1. Faulty Return Authorization Policies

Proprietary SCU research has found that cases of blatant cyber shoplifting are not nearly as prevalent as tangible product retails assume—the merchant bears some of the responsibility too.

In more than 15% of chargeback cases, the cardholders did return the merchandise—they weren’t making false claims with the issuer. They filed a chargeback because they genuinely felt they had a valid case since the merchandise was returned but a refund wasn’t issued.

However, just because the merchandise was returned doesn’t mean it qualifies for a refund.

If a product return is unauthorized, merchants must contact the customer to resolve the issue. At the very least, the merchant should refuse delivery of these shipments.

Although these chargebacks are usually unavoidable, accepting a returned package that doesn’t qualify for a refund leaves the merchant without any rights to dispute the chargeback.

2. Defective Merchandise Terms

Terms of service and policy pages are rarely read by consumers before completing a transaction; however, they are still vitally important.

If merchants don’t establish and publish a policy for defective claims, they’ll lose every chargeback dispute they attempt—as well as incur more chargebacks in the future.

Fortunately, this is a simple fix. All that’s required is a single paragraph on the policy page that outlines the process for defective merchandise.

3. Soft Descriptor Errors

Some merchants are unaware that there are two parts to their billing descriptor.

- The Soft Descriptor: This is what appears on the statement while the transaction is in the authorization stage—which can last 72 hours or longer.

- The Hard Descriptor: This information remains on the statement once the transaction is settled.

The hard descriptor is what merchants are usually most concerned with, but if there is an issue with how the business is portrayed, it’s usually in the soft descriptor.

There are various issues that could arise.

- The descriptor might get truncated so the cardholder doesn’t receive the full message.

- Since each card issuer has different requirements for the descriptor, it might appear fine for one cardholder but indecipherable for another.

- A typo could have been made during the application or setup process, meaning things like the legal name shows instead of the DBA, the phone number is actually the fax number, etc.

Because soft descriptors can be visible for days, a savvy cardholder who checks account activity regularly might be confused and mistake the transaction for fraud.

4. Not Matching Chargebacks to Sales Transactions

Based on a recent survey of over 200 retailers, less than 25% were confident that they were correctly matching 100% of their chargebacks to the original sales transactions. This management task is far more difficult than some believe because of the different formats and frequency gaps.

Unfortunately, an inability to match the chargeback to the correct sales information means more chargebacks are probable in the future. If merchants are unable to obtain corresponding sales records, they won’t have the compelling evidence needed to dispute friendly fraud. And, 50% of all friendly fraud cases will result in a duplicate attempt in less than 60 days if the merchant doesn’t intercept and dispute the original illegitimate chargeback.

Research has shown that if merchants in certain verticals don’t have the time or technology to match these records in their system within five days of the posting date, chargeback activity will increase by nearly 50%.

Comprehensive Protection That Works

These four merchant errors are part of the 106-point inspection conducted through SCU’s Merchant Compliance Review. While auditing for the four errors mentioned here will greatly reduce your risk exposure, they just scratch the surface of true chargeback prevention.

In total, there are 106 chargeback-inducing merchant errors. Would you like help checking for potential risk exposure?

Unfortunately, identifying additional errors beyond what we’ve highlighted will be challenging. It is difficult for merchants to remain objective and provide an unbiased review of their own policies and procedures. Plus, merchants lack the expertise and insight to know what to look for.

If you are ready to identify all possible sources of preventable chargebacks, eradicate merchant error, improve your brand’s reputation, and stop needless revenue loss—contact Strong Call United today.

SCU is the only service provider on the market today to guarantee both performance and ROI. Don’t wait another second to secure comprehensive protection. With our guarantee, you have nothing to lose.

No comments:

Post a Comment